-

January,11,2017

“If we don’t make our own future, it will be made for us.” ― Mike Klepper January is typically the time of year that people make resolutions and attempt to change their lives. And why not? A new year is…Continue Reading

-

December,27,2016

As 2016 comes to a close, and we look forward to spending time with our family, it is also a natural time to reflect on the past year. At Lifetime Financial Services, we marked our 10th year as an independent…Continue Reading

-

November,18,2016

The numbers quoted in this Financial Post article are uninspiring. If you find you are uncomfortable with your financial situation, do not be afraid to ask for help. Find an advisor that you are comfortable with and understand your situation….Continue Reading

-

May,3,2016

When we give seminars on retirement planning, there are usually quite a few attendees who are surprised to realize that there is a real possibility that they may be retired for nearly as long as they plan to work. For…Continue Reading

-

March,23,2016

2016 Budget Overview The new Liberal government delivered its first federal budget on March 22 in Ottawa. While you’ve probably seen plenty of media coverage, we thought you would appreciate an overview of how some of the budget items relate…Continue Reading

-

February,5,2016

Do you feel that you can time the market? This game let’s you try without anything to lose (or gain). It can be found on the Quartz website. This game will show you just how foolish it is to sell…Continue Reading

-

January,25,2016

Here is an article presented by Fidelity Investments recapping the markets in Canada and other regions around the globe. It looks like Canada’s TSX was the poorest performer among the G7 countries. It is important to remember in times like…Continue Reading

-

January,14,2016

The TFSA contribution limit has been reduced to $5500 per year starting Jan 1, 2016. This article by Peter Wouters (Director, Tax Retirement & Estate Planning Services, Wealth) of Empire Life explains the changes. If you have any questions about…Continue Reading

-

January,14,2016

I had some great questions about gifting and joint accounts at an Estate Planning seminar I held earlier this week. This article address some of the concerns surrounding giving gifts. If you need any more information, please feel free to…Continue Reading

-

October,27,2015

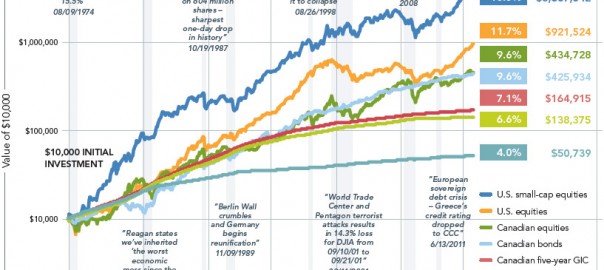

With the recent volatility of the markets, it is important to remember that, historically, the markets go up more than they go down, as illustrated by the graph “Up vs Down Markets” from Fidelity Investments. It is also important to…Continue Reading