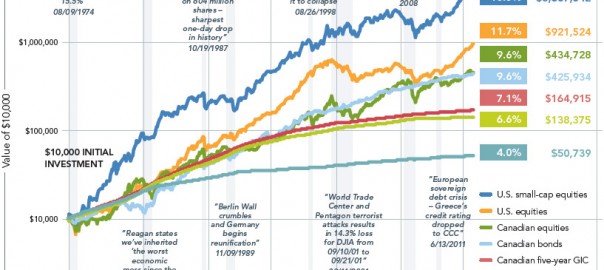

With the recent volatility of the markets, it is important to remember that, historically, the markets go up more than they go down, as illustrated by the graph “Up vs Down Markets” from Fidelity Investments. It is also important to not react emotionally to the changes in the markets, either down or up. No one can predict what the markets will do next, so withdrawing and investing your savings in an attempt to time the markets will only result in frustration and lost opportunities. The Fidelity illustration called “Don’t Miss Out“shows this.

When investing, a few simple tips can help your piece of mind and help ease you through market changes:

1. Invest with a realistic goal

2. Establish a realistic time frame for your goal

3. Have target returns

4. Identify your investment comfort levels

5. Choose investments that match your comfort levels, goals and time frame

6. Review the proceeding points regularly

7. After a rational review, make any adjustments needed to stay on course

8. Keep calm & invest on – during periods of volatility remember why you are investing in the first place

And remember, you can call your advisor at any time to help you out. Chances are your advisor has seen it all before.

If you would to talk to us about this or any other financial issue you have, we would love to hear from you.