When we give seminars on retirement planning, there are usually quite a few attendees who are surprised to realize that there is a real possibility that they may be retired for nearly as long as they plan to work. For example, an individual who starts working full time at 25 and retires at 65 will have worked for 40 years. If that individual lives until the age of 95, not an unreasonable expectation these days, they will have been retired for 30 years. According to the Toronto Star article “As we live longer, 5 things to consider” (see link below), new studies indicate that average life expectancy today is now 89 years for women and 87 years for men. That means that the average retirement will last 24 and 22 years respectively. For perspective, the article also points out that the average life expectancy when CPP was introduced in the 1960s was 74 years. People were only expected to live approximately 10 years past retirement. Will life expectancy increase in the next 50 years as well?

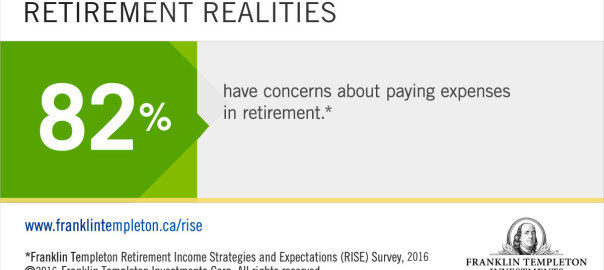

While living longer is great news, it means that there will be greater stress on our retirement savings. Individuals need to become actively involved in their own retirement planning. Simply contributing a percentage of your salary to your group plan at work or depositing money into your RRSP at the bank is not enough. Neither is hoping that the government will cover our deficiencies. Definite time and investment goals need to be established and reviewed regularly, as well as an understanding of the investment tools that will help achieve those goals.

Then, once retirement is reached, how do those savings turn into an income that can last 30 years? Again, monetary and time goals are needed along with an idea of how you want to spend your retirement. These goals will help determine the investment tools and strategies that will work best for your situation.

The articles linked below – “As we live longer, 5 things to consider” from the Toronto Star and “Retire on your terms” from Franklin Templeton investments – both give insight into some of the issues that we may face when planning our retirement. And since everyone’s retirement is unique and faces specific challenges, don’t be afraid to look for help and ask questions.