After over 2 years of straight up growth, the markets have returned to more normal periods of volatility. While these are a regular and expected part of market activity, it never feels good to experience them. It is our feelings that compel us to want to react and do the primary activity to wealth destruction – buying high and selling low. The good news is that you can have professional managers keeping watch over you money, who make objective, unemotional, professional decisions to help you build wealth every day. These professionals are taking advantage of market volatility to ensure that your money is participating in the primary activities of wealth creation – buying low, staying invested, compounding growth and eventually selling high.

More good news is that this market volatility is not nearly as bad as you feel or as the media wants you to feel. Market valuations which were looking stretched at the beginning of the year now look attractive as stocks are trading below their historical average prices in relation to their earnings. The probabilities of a global recession are low and the global economy and corporate profits are in line for another year of growth, albeit slower growth than the last couple of years. But slower growth is far from a disaster scenario. In fact, economic and profit growth means that investors could continue to see positive returns over the coming year.

In the short-term, the market needs to hash out a few uncertainties – rising interest rates, slower global growth and corporate earnings and how trade relations between countries will affect those two factors. As mentioned above, this is not a case of contraction, but simply one of slowing growth. How the market deals with uncertainty is to price in the worst case scenario and then float back up as reality becomes clear. Unfortunately it may take a few months for the market to get a clear enough picture to feel comfortable moving forward again, or it could gain that comfort tomorrow. The reality is none of us knows that timeline for sure. But what is clear is that once investors find that comfort, these markets will begin once again to move forward and quickly erase the gains of the past months. It is our job to make sure that you are there, participating in market growth when it happens.

It is at times like these where it is important to review how smart people have become wealthy overtime, to ensure our emotions don’t lead us away from that good behavior. How the smart money builds wealth is not complicated, it’s really quite simple. But simple does not mean easy. Part of our job, is to make it easier for you to stay with the smart money and grow your wealth so you can enjoy your life to the fullest.

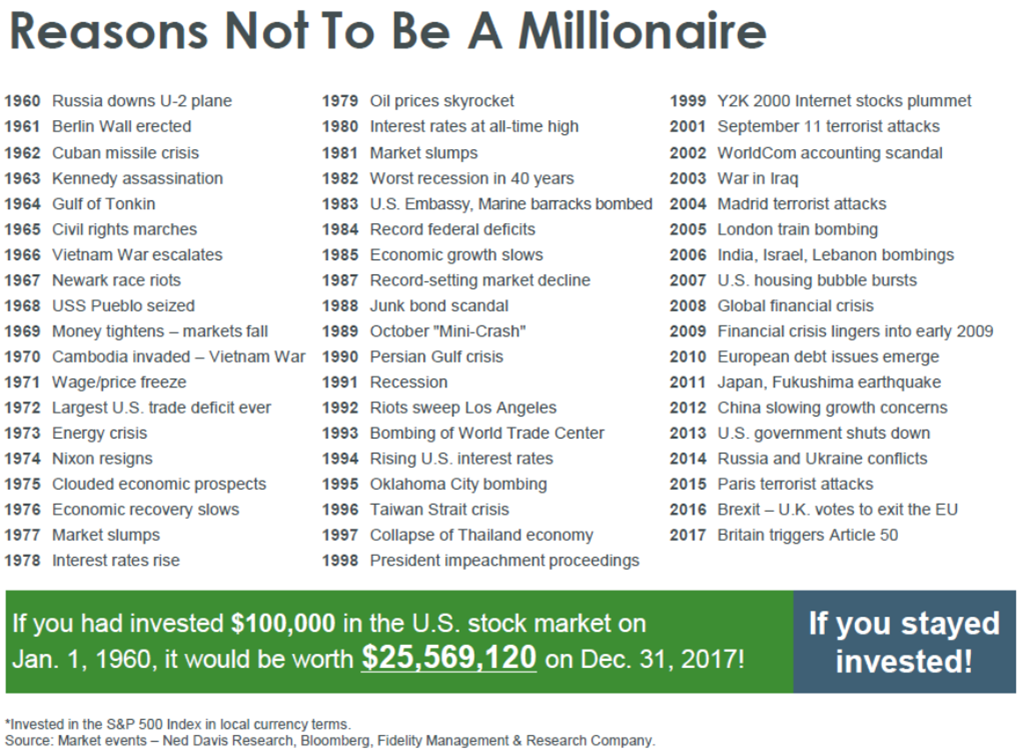

There are always reasons to scare us off the path. Always temptations to participate in the wealth destructing behaviors listed above. In fact, if we go back over the last 50+ years, we can see there was a reason every year to want to run away from volatile stock markets and bury our money in a bunker where it can be safe and restrained. If there was ever a time not to invest, it was the 1960’s. The tumultuous presidency of JFK took investors through violent race tensions, a building of military tensions between the 2 superpowers of the world – the U.S. and Russia, and ended sadly in JFK’s assassination. The peak of fears for investors came in 1962 during the Cuban missile crisis when the world’s 2 biggest military powers sat with their fingers over the button, ready to launch their large missile arsenals at each other. The world was literally on the edge of blowing up. Yet, if you had invested $100,000 in the U.S. stock market back then and despite wars, recessions, crisis, scandals and varied amounts of volatility, you had kept your money invested. You would have over $25 MILLION today!

This is what the smart money understands and how smart people have built wealth for generations. They understand the power of investing in the growth of companies and their unrelenting pursuit to make money over time. Like smart business people they understand that life will always be fraught with uncertainty and therefore volatility. But they see through the uncertainty to the opportunity before them. For most of us, the uncertainty of life and therefore markets makes investing seem like a gamble. And we are not wrong, there are similarities. But the difference is when it comes to investing in stock markets we are not the chump walking into the casino who will eventually lose all of his or her money. When investing in the stock markets we are more like the casino, taking the risk of loss with each game, knowing we will make money over time.

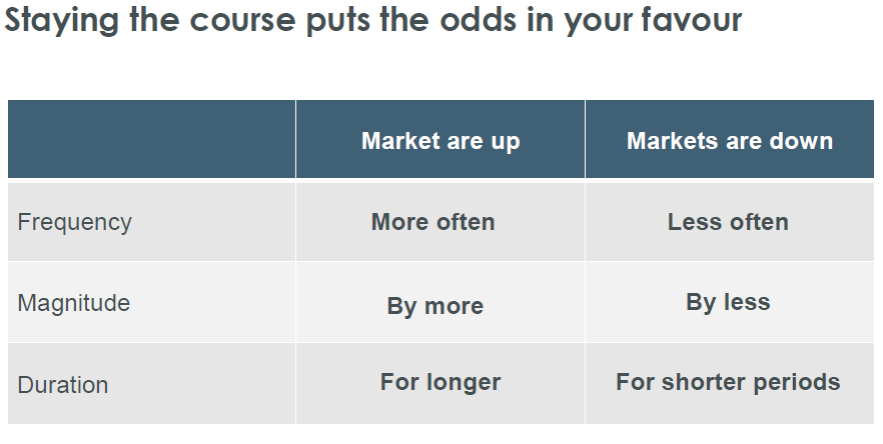

How does a casino profit over time when it takes so much risk gambling with its patrons? Why do smart business people invest in casino’s and profit off them over time? The reason is simple – the odds are in their favour. The casino will only gamble on games where the odds are in their favour to win. Then they work to encourage their patrons to play those games over and over again. Because the more times they play, the more the odds will play out over time and the casino will win. This is the same as investing in the stock market. We know the odds are in our favour to win. Stock markets go up more often, for longer and by higher amounts than they go down. This means that odds are in your favour that if you put money in the stock markets you will win more often and by more than you will lose. But like the casino, for the odds to work in your favour you have to keep playing.

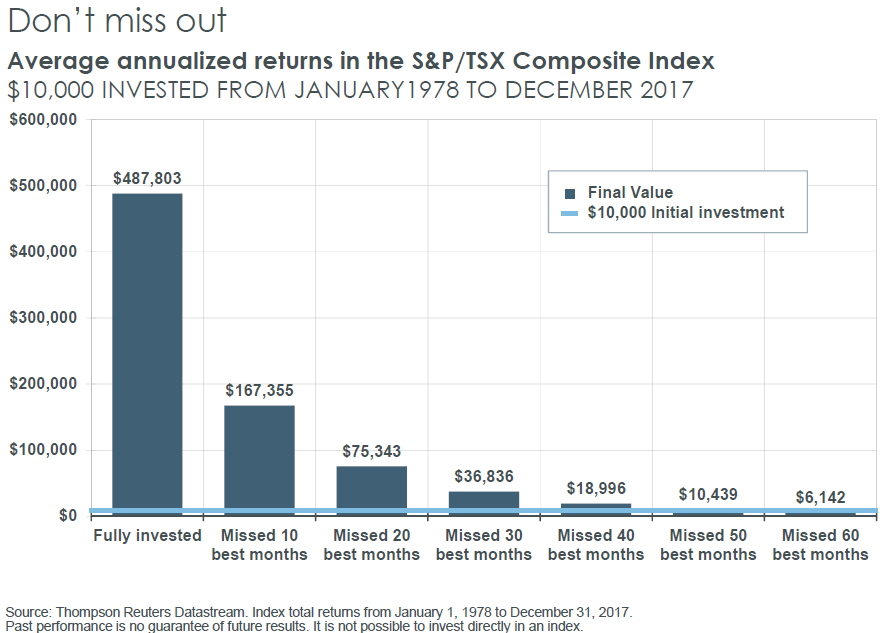

The biggest mistake investors make, is thinking that they can only play when there is a winning hand. If only we could know when that was. The reality is that investors who try to time the market, only serve to reduce their odds of success and erode their gains over time. In fact, over the past 40 years, investors who had tried to time markets and missed the 10 best months in the market – that’s only 2% of the months over that period. So put another way, those investors who had tried to time the market and got it right 98% of the time and just got it wrong 2% of the time – gave up over 50% of their return. In fact, those investors that were lucky enough to be 85% accurate would have still given up ALL their potential return. Yet, had they just stayed in vested in the S&P/TSX index stock over that period they would have made over 48 times their money. (See chart below 487803/10000=48.78)

The smart investors understand that investing in stock markets is about playing the odds. And that to benefit in those odds you have to keep playing as often as possible. The longer you are invested and the more days you are in the market, the better potential to grow your wealth. They understand that to participate in the odds they will have to lose some days, months and even years. But by continually participating, the odds are in their favour to build significant wealth.

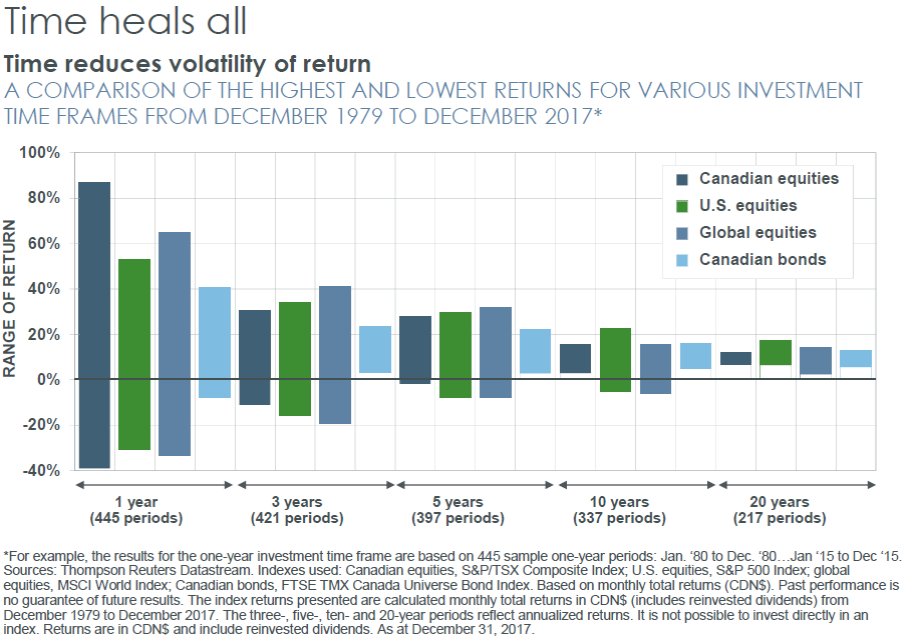

If you were to look over any 1 year period historically in Canadian stocks, you would see that you could have had a return on the S&P/TSX of anywhere between around -40% to +85%. But, if you took your focus off 1 year and rode it out over 3, 5, 10, 20 years, the probability of loss declines and the probability of gains increase. While over one year there is a wide range of possibilities, 20 year periods invested in Canadian stock markets would have had a potential average annual compound return of anywhere between 7% – 12%. The smart money understands that if they stay in, they have great odds of growing their money at incredible rates.

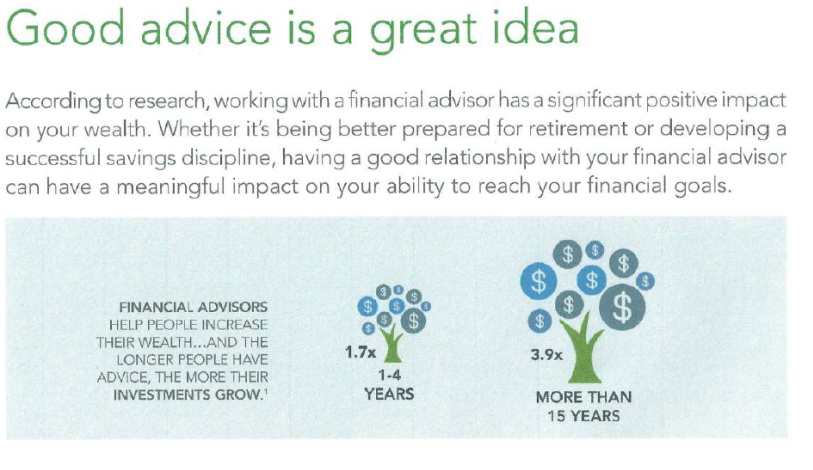

It is our job to make sure that you invest like the smart money and build your wealth up to and through retirement. Remember that the day you retire you DO NOT become a short-term investor. Odds are that you will be retired and need to live off your money for 20 to 30 years. So while you may need 1/20th or 1/30th of you money the year you retire, you will not spend much of your money for 20 or more years. So as your advisor, we continue to focus on ensuring you participate in these incredible odds to build wealth. That is why smart investors who heed the advice of financial professionals like us, will be up to 4 times wealthier than those who heed the advice of their emotions.

1 Centre for Interuniversity Research and Analysis of Organizations 2016

If you wish to discuss what is going on in the markets and how it affects your long-term financial plans, please give me a call or email.

Sincerely,

Chris

P.S. If you want to know more about risk and odds, I would recommend reading Against the Gods by Peter L. Bernstein.